In the relationship between employers and employees, most workers are always in a weaker position, so the State, which plays the role of managing social order, has policies to balance the interests of both sides. Workers – especially unskilled and low-skilled workers – often have their rights violated, but they are often the ones who do not understand the law to protect themselves. Therefore, to help workers understand their rights, ADSMO would like to briefly introduce 14 things you need to know to protect yourself.

Maximum probationary period

1.1. Not more than 180 days for the work of an enterprise manager as prescribed by the Law on Enterprises, the Law on Management and Use of State Capital Invested in Production and Business at Enterprises.

1.2. Not more than 60 days for work with a professional title requiring professional and technical qualifications from college level or higher.

1.3. Not more than 30 days for work with a professional title requiring professional and technical qualifications at intermediate level, technical workers, and professional staff.

1.4. No more than 06 working days for other jobs.

The probationary salary must be at least 85% of the official salary

For example: The official salary is 8 million, then the probationary salary is at least 6.8 million.

3 days before the end of the probationary period, the employee must be notified of the probationary results

– If the requirements are met, the labor contract must be signed immediately.

– If the requirements are not met, the probationary contract can be terminated.

Therefore, if the employer violates the regulations, it will be fined from 2 to 5 million and forced to pay 100% of the employee’s salary.

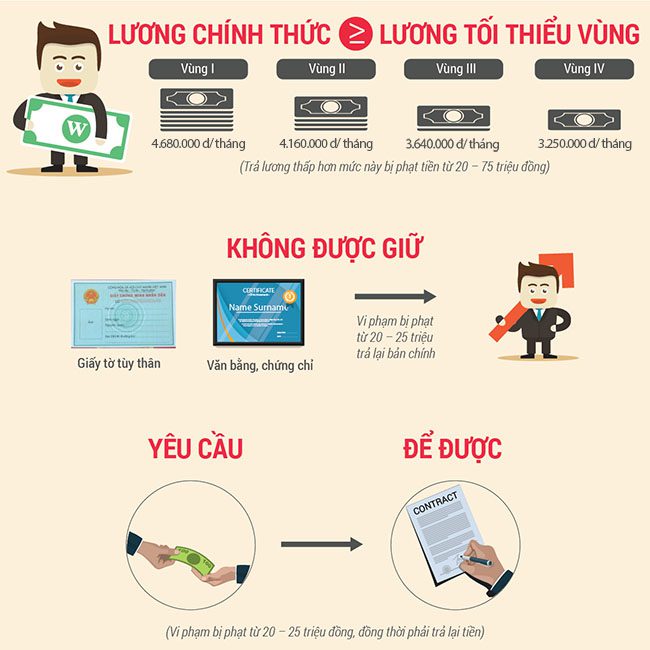

Official wages must not be lower than regional minimum wages

According to Decree 38/2022/ND-CP effective date 01/07/2022, the minimum wage by region is currently regulated by the State at:

– Region I: 4,680,000 VND/month

– Region II: 4,160,000 VND/month

– Region III: 3,640,000 VND/month

– Region IV: 3,250,000 VND/month

If paying wages lower than this prescribed level, employers will be fined from 20 to 75 million VND. Pursuant to Clause 3, Article 17 of Decree 12/2022/ND-CP Effective date: January 17, 2022.

It is not allowed to keep the original identity papers, diplomas, and certificates of employees

If the Employer keeps the original identity papers, diplomas, and certificates of employees, he/she will be fined from 20 to 25 million VND and must return the money to the employee.

Requiring employees to pay money to sign a labor contract

If an employer violates the above provisions, he/she will be fined from 20-25 million VND and must return the money to the employee.

Overtime wages

During the day:

– Normal days: 150% (salary Actual hourly wage * 150% * overtime hours)

– Holidays: 200% (actual hourly wage * 200% * overtime hours)

– Holidays: 300% (actual hourly wage * 300% * overtime hours)

At night:

– Normal days (Employees do not work during the day): 200% (actual hourly wage * 200% * overtime hours) more)

– Normal days (Employees working during the day): 210% (actual hourly wages * 210% * overtime hours)

– Holidays: 270% (actual hourly wages * 270% * overtime hours)

– Holidays: 390% (actual hourly wages * 390% * overtime hours)

According to Article 106 of the Labor Law, nighttime working hours are calculated from 10:00 p.m. to 6:00 a.m. the next day. If the employer does not pay the correct salary, they will be fined from 5-50 million VND.

Holidays and leave are regulated

According to the 2019 Labor Law, Code No.: 45/2019/QH14, effective from January 1, 2021, employees will have 11 days off for holidays and Tet, with full pay.

- New Year’s Day: 01 day (January 1st)

- Lunar New Year’s Day: 05 days

- Victory Day: 01 day (April 30th)

- International Labor Day: 01 day (May 1st)

- National Day: 02 days (September 2 and 01 day before or after)

- Hung King’s Commemoration Day: 01 day (10th day of the 3rd lunar month).

– Foreign workers working in Vietnam, in addition to the holidays prescribed in Clause 1 of this Article, are also entitled to 01 traditional New Year’s Day and 01 National Day of their country.

For employees who have worked for 12 months for an employer, there will be:

– 12 days of paid leave, for those working in normal working conditions usually.

– 14 days of paid leave for those doing heavy, toxic, or dangerous work or those working in places with harsh living conditions according to the list issued by the Ministry of Labor – Invalids and Social Affairs in coordination with the Ministry of Health, or for underage workers or workers with disabilities.

– 16 days of paid leave for those who do particularly arduous, toxic, or dangerous work or those who work in places with particularly harsh living conditions according to the list issued by the Ministry of Labor, War Invalids and Social Affairs in coordination with the Ministry of Health.

– In case an employee has worked for less than 12 months for an employer, the number of annual leave days is proportional to the number of months worked. If the total number of working days and paid leave days of the employee (holidays, New Year, annual leave, paid personal leave according to Articles 112, 113, 114 and 115 of the Labor Code) accounts for 50% of the number of normal working days in a month as agreed, that month is considered 01 working month to calculate annual leave days.

The formula for calculating the number of annual leave days is as follows:

Number of leave days = [(Number of leave days when working for a full year + Number of seniority leave days (if any))/ 12] x Actual number of working months

For example: Mr. B has worked for Company X for 06 months, under normal conditions, the number of annual leave days of Mr. B = (12 days : 12) x 6 months = 6 days.

– For employees, annual leave will increase according to seniority. Specifically, according to Article 114, the 2019 Labor Code stipulates:

- Annual leave days increase according to seniority.

- For every 5 years of working for an employer, the employee’s annual leave will be increased by 1 day.

Thus, when working for a business for 5 years, from the 6th to the 10th year of working there, the employee will be given 1 additional day of leave/year. Working from the 10th to the end of the 15th year, the employee will be given 2 additional days of leave/year. Working from the 16th to the end of the 20th year, the employee will be given 3 additional days of leave/year…

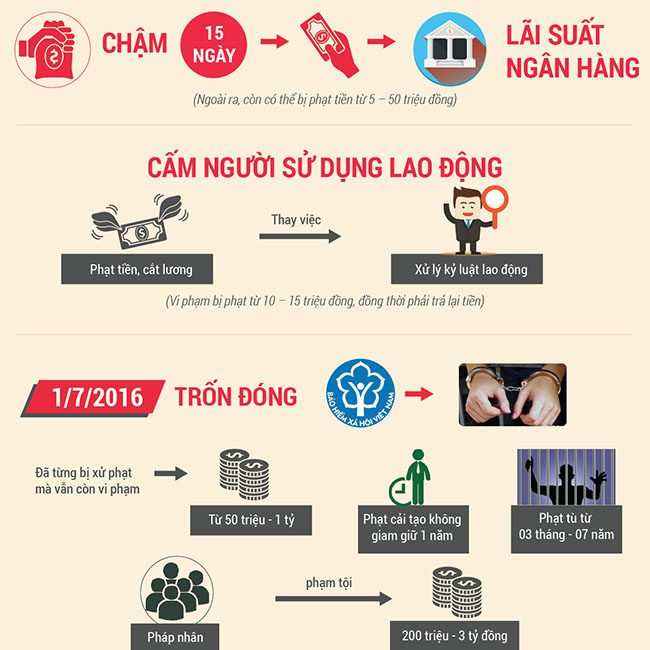

Late payment of wages, underpayment of wages for more than 15 days

From the date April 15, 2020, Decree 28/2020/ND-CP stipulates that administrative violations against employers (individuals) will be fined from 5-50 million VND if they do not pay wages on time to employees, the level of fine depends on the number of employees violated.

For employers that are organizations, the fine is doubled. Thus, employers that are organizations will be fined up to 100 million VND if they pay wages late to employees.

In addition, according to Article 97 of the 2019 Labor Code, in case of force majeure, the employer has taken all measures to remedy the situation but cannot pay wages on time, the delay must not exceed 30 days; If the salary is paid late for 15 days or more, the employer must compensate the employee with an amount at least equal to the interest on the late payment calculated at the interest rate on 1-month term deposits announced by the bank where the employer opens the employee’s salary account at the time of salary payment.

Fines and salary cuts instead of labor discipline

According to the provisions of Clause 3, Article 15 of Decree 95/2013/ND-CP, enterprises will be fined from 10-15 million VND if they use fines and salary cuts instead of labor discipline, and must return the money collected from employees.

Evading payment of Social Insurance, Health Insurance, Unemployment Insurance for employees

Evading payment of social insurance, health insurance, unemployment insurance for employees will be subject to a fine of 50-200 million VND or a non-custodial reform sentence of up to 2 years or a penalty of 3 months to 1 year. If the violator has been previously punished for a violation but still re-offends, the individual violator can be fined up to 1 billion VND or a penalty of up to 7 years. A legal entity that commits a crime will be fined from 200 – 3 billion VND.

Female workers during menstruation or nursing children have a minimum rest period during their shift

Female workers during menstruation are entitled to a 30-minute break during working hours and are still entitled to full wages according to the labor contract. The number of days off during menstruation is agreed upon by both parties in accordance with the actual conditions at the workplace and the needs of the female worker, but is at least 3 working days in a month. The specific time off for each month is notified by the employee to the employer. Female workers who are nursing a child under 12 months old will be given 60 minutes of rest each day. In case a female worker does not need to rest and the employer agrees to let her work, in addition to the salary as prescribed in Point a of this Clause, the worker will be paid additional salary according to the work she did during her rest period and this working time will not be counted as overtime hours of the worker.

Not ensuring the old job when a female worker returns to work after the end of her maternity leave and the above violations will be subject to a fine of 10-20 million VND.

The Chairman of the People’s Committee or the Labor Inspectorate is where employees can request administrative sanctions against employers

Depending on the level of violation of the employer employers that employees can request the Chairman of the People’s Committee of the commune, district, or province, and then the Inspector, the Chief Inspector of the Department of Labor, War Invalids and Social Affairs or the Chief Inspector of the Ministry of Labor, War Invalids and Social Affairs to handle administrative violations of employers.

Employees are exempted from all court fees and charges when suing employers in court

Employees who sue to claim wages, unemployment benefits, severance pay, social insurance, compensation for work-related accidents, occupational diseases, to resolve compensation issues or for being fired or having their labor contracts terminated illegally are exempted from all court fees and charges.

Please connect with ADSMO via hotline 0356.105.388 to discuss and consult on Administrative – Human Resources software to help businesses and units operate more effectively.

Contact ADSMO now – Specializing in providing customized business software solutions, consulting on building digital platforms with the mission.

TOTAL Solution, BREAKTHROUGH Development – Optimize COST – Increase PROFIT. We are committed to bringing you:

- Management solutions tailored to your business needs.

- Easy-to-use and effective system.

- Professional customer support service.

Contact ADSMO now for free consultation:

- Address:8th Floor, HD Tower Building – 22 Pho Moi – Thuy Nguyen Ward – City. Hai Phong

- Website: https://adsmo.vn

- Email: info@adsmo.vn

- Hotline: 0356 105 388