Since the beginning of 2019, due to changes in regional minimum wages, many businesses have had to readjust their salary scales and payrolls. Many employees will wonder how to build new salary scales and payrolls.

If the regional minimum wage increases in 2019, are businesses required to readjust their salary scales and payrolls?

According to Decree 157/2018/ND-CP, the regional minimum wage in 2019 has increased compared to the regional minimum wage in 2018.

Accordingly, when building salary scales and payrolls, businesses must base on the current regional minimum wage to determine the salary level for each position and job. jobs, groups of jobs in accordance with the principles prescribed by law. Specifically:

– The lowest salary of the simplest job or position under normal working conditions must not be lower than the regional minimum wage.

– The lowest salary of a job or position requiring trained or apprenticed workers (including workers trained by the enterprise itself) must be at least 7% higher than the regional minimum wage.

– Compared to the salary of a job or position of equivalent complexity, working under normal working conditions, the salary of a job or position with arduous, toxic, or dangerous working conditions must be at least 5% higher; Jobs and positions with particularly arduous, toxic, and dangerous working conditions must be at least 7% higher.

However, an increase in regional minimum wages does not mean that businesses must redo their salary scales. Whether or not to adjust depends on the current salary scale of the business:

- Many businesses still believe that the lowest salary in the salary scale, the salary table must be higher than the regional minimum wage. But in fact, the law only stipulates that “it cannot be lower” but does not stipulate that this salary must be higher than the regional minimum wage. In fact, when building a salary scale, many businesses often stipulate that this salary is higher than the regional minimum wage to prevent the case that each time the regional minimum wage changes, the salary scale and salary table must be adjusted.

- If in the case that the lowest salary of the simplest job in the current salary scale of the business is lower than the regional minimum wage. Accordingly, when there is a change in the regional minimum wage and the minimum wage in the salary scale is lower than the current regional minimum wage, the enterprise must also rebuild the salary scale to match the 2019 regional minimum wage. At the same time, the enterprise must notify its Salary Scale and Salary Table to the Department of Labor, War Invalids and Social Affairs and register for adjustment of Social Insurance, Health Insurance, and Unemployment Insurance contributions with the social insurance agency when changing the salary of employees subject to compulsory social insurance.

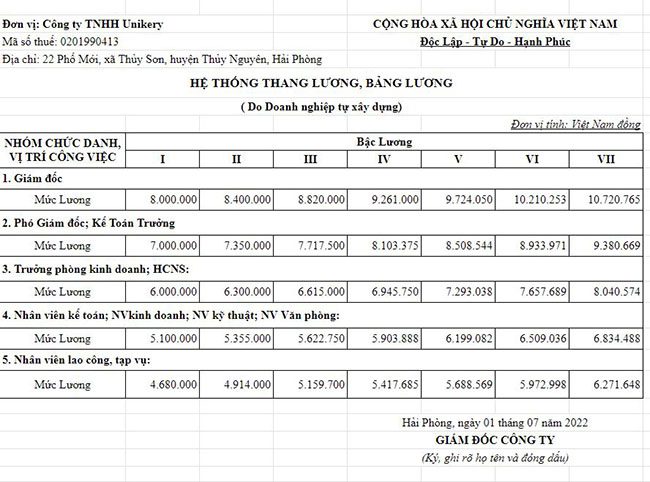

Can a business have multiple payrolls?

The law does not stipulate that each business can only build one salary scale or payroll. Therefore, a business can build many salary scales and payrolls.

For example, a business can create a payroll for management workers, a payroll for technical and professional workers, and workers directly involved in production, business, and service.

>>>Download the Salary Calculation Payment Table Template Here!

Enterprises with less than 10 employees do not have to develop salary scales and payrolls

According to Clause 2, Article 1 of Decree 121/2018/ND-CP, enterprises employing less than 10 employees will be exempted from the procedure of submitting salary scales and payrolls to the state labor management agency at the district level where the enterprise’s production and business establishments are located.

Thus, Decree 121/2018/ND-CP only stipulates that enterprises employing less than 10 employees are exempted from the procedure of submitting salary scales and payrolls, but does not stipulate that enterprises employing less than 10 employees are exempted from developing salary scales and payrolls.

Therefore, enterprises with less than 10 employees still have to build salary scales, salary tables and businesses will be fined from 4,000,000 VND to 10,000,000 VND if they do not build salary scales according to the provisions of Clause 10, Article 1 of Decree 88/2015/ND-CP.

>>>You may be interested in:

- Excel Salary Payment Table Template According to Circulars 200 and 133

Instructions for Creating a Salary Calculation Table in Excel and How to Use Common Functions

TOTAL Solution, BREAKTHROUGH Development – Optimize COST – Increase PROFIT. We are committed to bringing you:

- Management solutions tailored to your business needs.

- Easy-to-use and effective system.

- Professional customer support service.

Contact ADSMO now for free consultation:

- Address:8th Floor, HD Tower Building – 22 Pho Moi – Thuy Nguyen Ward – City. Hai Phong

- Website: https://adsmo.vn

- Email: info@adsmo.vn

- Hotline: 0356 105 388