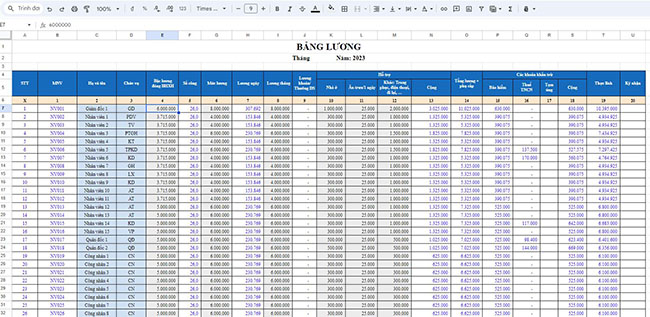

Excel is a powerful and flexible tool, suitable for calculating and managing salaries. In this article, ADSMO will show you how to create a salary spreadsheet in Excel and use common functions to make calculations easy and accurate.

In the article “Excel Salary Payment Table Template According to Circular 200 and 133” ADSMO also mentioned that businesses are allowed to design their own salary payment tables that are suitable for their specific characteristics and convenience. However, regardless of how they are built and calculated, this salary table template also needs to be based on a number of factors:

- Timesheet

- Labor contract

- Regional minimum wage (updated according to the latest regulations)

- Taxable and non-taxable personal income

- Amounts included in premiums and not subject to social insurance

- Insurance deduction rate for business expenses and employee salaries

After ensuring the above factors, we will learn about:

Basic items when applying salary calculation on Excel

Usually the main components of a payroll will include:

- Main salary

- Allowances (including Allowances Subject to Social Insurance Contributions According to the 2023 Labor Law and allowances not subject to social insurance)

- Total income

- Working days

- Actual salary

- Social Insurance Contribution Salary

- Insurance deduction rate

| Salary deductions | Included in business expenses | Included in employee salaries |

| Social insurance (social insurance) | 17% | 8% |

| Health insurance (health insurance) | 3% | 1.5% |

| BHTN (unemployment insurance) | 1% | 1% |

| KPCĐ (union fund) | 2% | |

| Total | 23% | 10.5% |

8. Personal Income Tax

9. Advance

10. Real field

>>> Download the Salary Calculation Payment Table Template Excel according to Circulars 200 and 133 Here!

How to create a salary calculation table on Excel and some common functions

Step 1: Prepare data

First, you need to prepare data such as employee names, employee number, job title, hours worked, base salary, and any other allowances or benefits. Make sure the data is in the appropriate columns.

Step 2: Create a new spreadsheet in Excel

Open Microsoft Excel and create a new spreadsheet. Name the data columns for ease of use.

Step 3: Calculate salary for employees

Is the agreed salary in the Labor Contract and allowances, salary levels, and bonuses according to the regulations of the Enterprise.

Step 4: Calculate deductions

In the payroll, there may be deductions such as Social insurance, health insurance, personal income tax, etc. to calculate taxable income. To calculate the total taxable income for each employee, you can use the formula to subtract deductions from their total income.

Step 5: Calculate total salary

Step 6: Calculate net salary

To calculate net salary, you need to determine other deductions such as deductions and advances (if any).

Step 7: Customize the format

To make your payroll easier to read and more professional, you can customize the amount format, add your signature, company logo, and use colors to highlight important information.

Step 8: Save and use

Finally, save the payroll spreadsheet and use it in managing monthly salaries for your employees you.

Some common functions in salary calculation tables in Excel

| Function | Syntax | Meaning |

| 1. IF function | IF (condition, value A, value B). | If the condition is satisfied, the value A will be obtained, if the condition is not satisfied, the value B will be obtained. |

| 2.IF(OR) function | IF(condition (either Condition 1, or Condition 2, or Condition 3,…), value A, value B) | If 1 of n conditions is satisfied, the value will be A, if none of the conditions is satisfied, the value will be B. |

| 3.IF(AND) function | IF(condition (Condition 1, Condition 2, Condition 3,…), value A, value B) | If n conditions are satisfied at the same time, the value will be A, if none of the conditions are satisfied, the value will be B. |

| 4.IFERROR function | IFERROR(value) | If The error cell will display the value 0 |

| 5. Nested IF function | IF(condition 1, value A, if(condition 2, value B, condition 3, value C…..value H))) | If condition 1 is satisfied, it will give value A, condition 2 is satisfied, it will give value B,… If no value is satisfied, it will give value H. Commonly used formula to calculate personal income tax |

| 6. COUNT Function (Count Number of Cells Containing Numbers) | COUNT(value1, [value2], …) |

|

| 7. COUNTIF Function (Count cells based on multiple criteria/conditions) | COUNTIF(range, criteria) |

|

| 8. COUNTIFS function (Count cells based on multiple criteria/multiple conditions) | COUNTIFS (criteria range 1, criteria 1, [criteria range 2, criteria 2],…) |

|

| 9. COUNTA function (counts the number of non-blank cells in a range.) | COUNTA(value1, [value2], …) |

|

| 10. Sum Function (Calculate the sum of numbers) | SUM((number1,number2, …) or Sum(A1:An) |

|

| 11. Sumif Function (Calculate the sum with conditions) | SUMIF(range, criteria, [sum_range]) |

If the sum_range argument is omitted, Excel sums the cells specified in the range argument (the same cells to which the criteria are applied). |

| 12. Sumifs Function (Sum with Multiple Conditions) | SUMIFS(sum_range,criteria_range1,criteria1, criteria_range2,criteria2…) |

|

| 13. Time processing functions |

|

|

| 14. VLOOKUP Function | VLOOKUP(lookup_value,table_array,col_index_num,[range_lookup]) | This is the most popular search and query function. However, the search object (lookup_value = Employee Code / Employee Name) must be within the first column on the left of the lookup table (table_array = Employee List Table). |

Above are basic instructions on how to create a payroll spreadsheet in Excel and use some common functions. Depending on the specific needs and requirements of your company or organization, you can customize the spreadsheet and use other functions to suit your payroll process. Or more simply, use the software HRM Plus+ of ADSMO with modules such as human resource information management, timekeeping management, payroll calculation, recruitment management, approval of leave and business trips, diverse customization according to the requirements and characteristics of each business. Contact Hotline: 0356.105.388 to receive advice from our team of experts.

>>>See more: How to calculate salary for employees

Contact ADSMO now – Specializing in providing customized business software solutions, consulting on building digital platforms with the mission.

TOTAL Solution, BREAKTHROUGH Development – Optimize COSTS – Increase PROFIT. We are committed to providing you with:

- Management solutions tailored to your business needs.

- Easy-to-use and efficient systems.

- Professional customer support services.

Contact ADSMO now for a free consultation:

- Address:8th Floor, HD Tower Building – 22 Pho Moi – Thuy Nguyen Ward – City. Hai Phong

- Website: https://adsmo.vn

- Email: info@adsmo.vn

- Hotline: 0356 105 388