Overtime is the period of time worked outside of working hours specified in the contract based on the contract. To have overtime, the employer must have the consent of the employee, the number of overtime hours must not exceed 50% of the prescribed working hours in 1 day, according to Article 107 of the 2019 Labor Law. Employees must be arranged to take compensatory time off after each overtime period of many consecutive days in a month. How overtime wages are calculated for employees will depend on the form of basic salary agreed with the employee in the previously signed labor contract. Specifically:

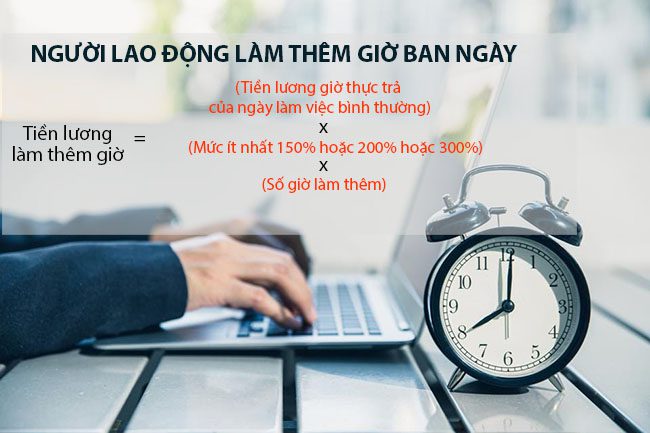

Overtime during the day

According to Articles 55 and 57 of Decree 145/2020/ND-CP, wages for overtime work are calculated according to the work formal.

For employees receiving wages by time, employers must ensure regulations on overtime and rest hours according to Articles 107 and 109 of the Labor Code.

| Overtime wages | = | Actual hourly wages paid on a normal working day | x | At least 150% or 200% or 300% | x | Overtime hours |

In which:

- The actual hourly wage paid for the work being done on a normal working day is determined by the actual wage paid for the work being done in the month or week or day that the employee works overtime (excluding wages overtime, extra wages for working at night, wages for holidays, Tet, paid leave as prescribed by the Labor Code; bonuses as prescribed in Article 104 of the Labor Code, initiative bonuses; mid-shift meals, allowances for gasoline, telephone, travel, housing, childcare, child care; support when a relative dies, the employee has a relative get married, the employee’s birthday, occupational diseases and other support and allowances not related to the performance of work or the title in the labor contract) divided by the total actual working hours corresponding to the month or week or day the employee works overtime (not exceeding the number of normal working days in the month and the number of normal working hours in 01 day, 01 week as prescribed by law that the enterprise chooses and excluding overtime hours).

- The minimum level is 150% compared to the actual hourly wage for the work performed on a normal working day, applicable to overtime hours worked on a normal working day.

The rate is at least 200% of the actual hourly wage for the work being done on a normal working day, applicable to overtime hours on a weekly day off.

The rate is at least 300% of the actual hourly wage for the work being done on a normal working day, applicable to overtime hours on holidays, New Year’s Day, paid leave days, not including the wage for holidays, New Year’s Day, paid leave days for employees receiving daily wages.

Example: Employee A signs a labor contract with an official salary 8,000,000 VND. Phone support: 200,000 VND/month. Meal allowance: 730,000 VND/month

Employee A’s hourly salary is calculated = Official salary / 26 Working days / 8 hours

Actual salary received according to normal working hours = 8,000,000/ 26 / 8 = 38,462 VND/hour

Overtime salary for 2 hours on a normal day = 38,462 x 150% x 2 hours = 115,385 VND

Money Overtime pay for 2 hours on Sunday = 38,462 x 200% x 2 hours = 153,468 VND

Overtime pay for 2 hours on Tet holiday = 38,462 x 300% x 2 hours = 230,769 VND

For employees paid by product or contract

| Overtime wages | = | Unit price of product salary for a normal working day | x | At least 150% or 200% or 300% | x | Overtime products |

Example: Worker A finished sewing 2000 shirts In the month, the unit price of the product is 2,000 VND/1 shirt with 208 hours and 60 hours of overtime on normal working days. The salary received is:

The hourly product salary is: 2,000 x 2,000/268 hours = 14,925 VND

The normal hourly product salary is: 14,925 x 208 hours = 3,104,478 VND

The overtime hourly product salary is: 14,925 x 150% x 60 hours = 1,343,284 VND

So the total salary that Worker A receives is: 4,447,761 VND

Working overtime at night

For employees working at night (from 10pm to 6am the next morning), in addition to paying wages and night work allowances (at least 30% more), employees are also paid an additional 20% of their wages calculated according to the actual wage unit price paid for work done during the day (as stipulated in Clauses 1 and 2, Article 98 of the Labor Code). (dynamic)

| Overtime wages at night | = | Actual hourly wages for the work being done on a normal working day | x | At least 150% or 200% or 300% | + | Actual hourly wages for the work being done on a normal working day normal working day | x | At least 30% | + | 20% | x | Hourly wages during the day of a normal working day or of a weekly day off or of a holiday, New Year’s Day, or paid leave | x | Number of working hours added at night |

Similar to the provisions of Article 98 of the Labor Law, on weekdays, the actual salary paid is calculated at least 150%; On weekly days off, at least 200%; On holidays, New Year’s Day, and paid leave days, at least 300% excluding holiday, New Year’s Day, and paid leave days for employees receiving daily wages.

Example: Employee A signs a labor contract with an official salary of 5,000,000 VND. Housing allowance: 1,000,000 VND. Meal allowance: 730,000 VND. The company has a working shift regulation

Shift 1 from 6am – 2pm

Shift 2 from 2pm – 10pm

Shift 3 from 10pm – 6am the next day

On the holiday of April 30, 2023, employee A went to work on shift 3 and worked 1 extra hour

Actual salary paid on a normal day is the basis for calculating salary = 5,000,000/26 days = 192,308 VND

Hourly salary is the basis for calculating salary = 192,308/8h = 24,308 VND

So the total salary that employee A receives is:

- Salary for April 30th holiday with full pay = 192,308 VND

- Salary for April 30th night shift work:

= 192,308 + 192,308 x 30% + 1,000,000 / 26 +730,000 / 26 = 316,539 VND

3. Overtime salary for 1 hour on April 30 = (24,308 x 300% + 24,308 x 30% +20% x 300% x 24,308) x 1 hour = 390% x 24,308 x 1 hour = 93,795 VND

Is overtime salary subject to personal income tax?

– Pursuant to Point i, Clause 1, Article 3, Circular No. 111/2013/TT-BTC dated August 15, 2013 of the Ministry of Finance guiding tax-exempt income:

“Article 3. Tax-exempt income

- Pursuant to the provisions of Article 4 of the Law on Personal Income Tax, Clause 9, Article 4 of Decree No. 65/2013/ND-CP, tax-exempt income includes:

Income from wages, salaries for night work, overtime paid higher than wages, salaries for day work, working within hours as prescribed by the Labor Code

Specifically as follows:

Salary, Higher wages paid for working at night, overtime is exempt from tax based on actual wages and salaries paid for working at night, overtime minus (-) the wages and salaries calculated on normal working days.

For example: Mr. A has a salary paid on a normal working day according to the provisions of the Labor Code of 30,000 VND/hour.

– In case an individual works overtime on a normal day, the individual is paid 60,000 VND/hour, the tax-exempt salary is:

60,000 VND/hour – 30,000 VND/hour = 30,000 VND/hour

– In case an individual works overtime on a day off or a holiday, the individual is paid VND 90,000/hour, the tax-free income is:

VND 90,000/hour – VND 30,000/hour = VND 60,000/hour

Working night shifts and overtime is a significant source of income for workers and also meets the production and business needs of many companies and enterprises with shift work. However, workers should also pay attention to the damage to health and nutrition when working overtime or night shifts.

>>>View more: How to calculate salary for employees

Contact ADSMO now – Specializing in providing customized business software solutions, consulting on building digital platforms with the mission.

TOTAL solution, BREAKTHROUGH development – Optimize COSTS – Increase PROFIT. We are committed to bringing you:

- Management solutions tailored to the needs of the business.

- Easy-to-use and effective system.

- Professional customer support service.

Contact ADSMO now for free consultation:

- Address: 8th Floor, HD Tower Building – 22 Pho Moi – Thuy Nguyen Ward – Hai Phong City

- Website: https://adsmo.vn

- Email: info@adsmo.vn

- Hotline: 0356 105 388